Publications

Mask, J. (2023). Salary History Bans and Healing Scars from Past Recessions. Labour Economics, 84, p. 102408.

Abstract: In a recession, increased competition forces inexperienced job market entrants to accept lower wages than those who start their careers during an economic boom. Despite years of improvement in labor market conditions following a recession, a wage disparity, known as scarring, persists between these cohorts. Recently implemented Salary History Ban laws (SHBs) are intended to reduce wage disparities between advantaged and disadvantaged groups. In this study, I test how these laws affect a unique and often less salient disadvantaged group – scarred workers. For scarred workers who began their careers during a moderate-to-severe recession, or a five percentage point higher state unemployment rate, I find SHBs increase job mobility by 0.6%, hourly wages by 2.65%, and weekly earnings by 5% relative to cohorts who graduated in baseline labor market conditions. These estimates represent a substantial reduction in the original scarring effect and provide a broader understanding of the mechanisms behind both scarring and SHB laws.

Mask, J. (2020). Consequences of immigrating during a recession: Evidence from the US Refugee Resettlement program. IZA Journal of Development and Migration, 11(1), 2020:0021.

Abstract: Are there long-term labor consequences in migrating to the US during a recession? For most immigrants, credibly estimating this effect is difficult because of selective migration. Some immigrants may not move if economic conditions are not favorable. However, identification is possible for refugees as their arrival dates are exogenously determined through the US Refugee Resettlement program. A one percentage point increase in the arrival national unemployment rate reduces refugee wages by 1.98% and employment probability by 1.57 percentage points after 5 years.

Working Papers

Does AI Help Economics Students Learn or Just Finish? A Classroom Field Study (2025)

Presented at the 23rd Annual Faculty Conference on Teaching Excellence

Abstract: This paper sheds new light on the effectiveness of AI tutoring systems in undergraduate economics education. Leveraging detailed usage data from a semester-long field study of 32 honors macroeconomic principles students across two sections at a large public research university, I find that each additional AI hint per question increased attempts by 0.683 (p < 0.01) but failed to improve homework grades, exam scores, or final course performance. Adoption was swift but short-lived: 87.1 percent of students drew at least one hint on the first homework, yet only 37.5 percent did so by the eleventh. Students who used the AI-Tutor more frequently tended to procrastinate less and reallocate effort away from homework, but they did not perform better on exams or final grades. The AI-Tutor’s perceived value was mixed: while 96 percent of students used it at least once, only 34.78 percent were satisfied with its performance. The findings suggest that while AI tutoring can engage students initially, it may not lead to deeper learning or improved outcomes in economics courses. Without pedagogical safeguards, early generation AI hint systems risk reinforcing surface completion rather than fostering mastery.

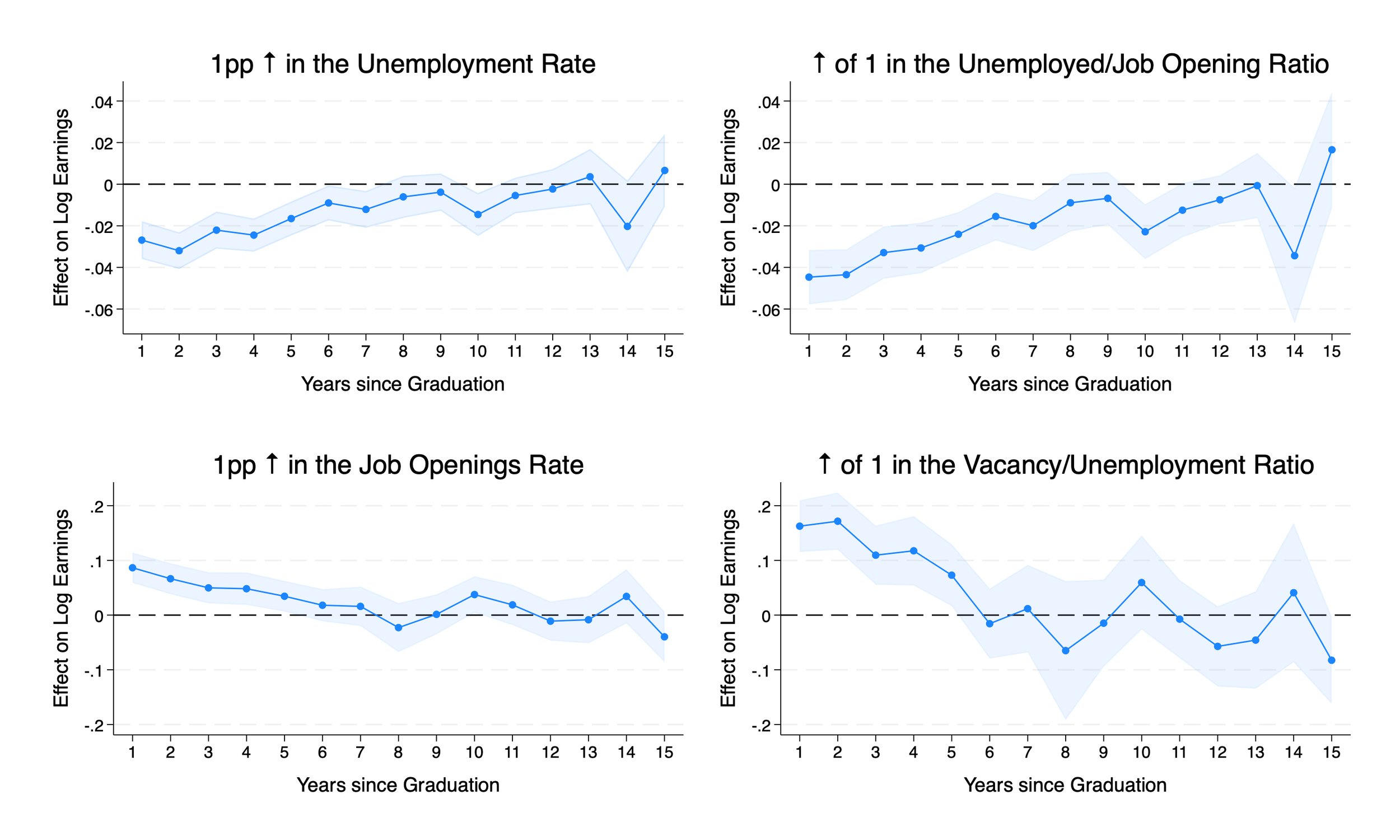

How Increased Labor Demand at the Start of Your Career Can Improve Long Run Outcomes (2022)

Presented at the AEA/ASSA, Eastern Economic Association, and Midwest Economics Association conferences

Abstract: The literature has traditionally focused on the local unemployment rate to estimate how initial economic conditions affect long-run outcomes. Using Job Openings and Labor Turnover Survey, or JOLTS, State Estimates for job openings, hires, and separations along with Local Area Unemployment Statistics, I test how changes in other aggregate measures of labor market activity affect long run outcomes. I find that for every one point increase in the local unemployed-to-job-opening ratio, annual earnings are reduced by 4.45% and remain depressed for over 13 years. Conversely, I find that a one percentage point increase in the local job openings rate or a one point increase in the local vacancy/unemployment ratio, increases initial annual earnings by 8.18% and 17.16%, respectively, which persists for nearly 11 years. I similarly find a positive and persistent effect on annual earnings from other measures of labor market tightness like the job-to-job transition rate, quits rate, job finding rate, and the labor-leverage ratio.

Latest version available here.